richmond property tax rate 2021

2022 Tax Rates. How are residential property taxes divided.

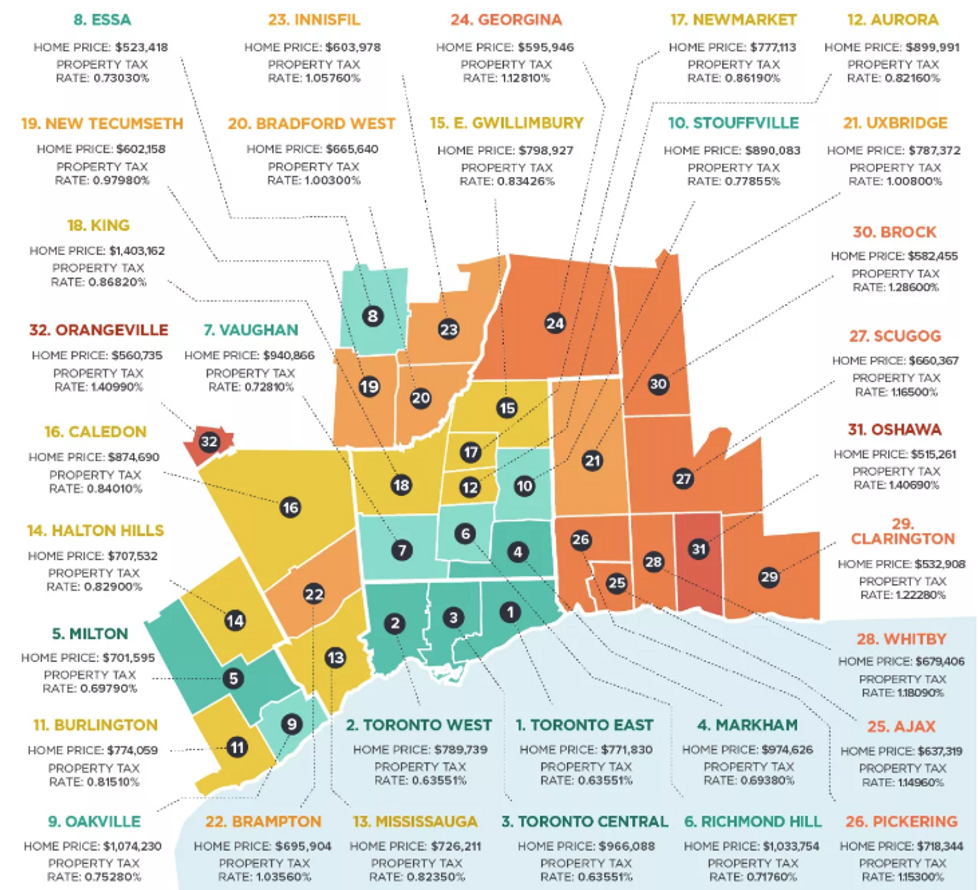

Ontario Property Tax Rates Lowest And Highest Cities

What is the real estate tax rate for 2021.

. Manage Your Tax Account. Due Dates and Penalties for Property Tax. NO -NEW-REVENUE TAX RATE 0670300 per 100 VOTER -APPROVAL TAX RATE 0630392 per 100 DE MINIMIS RATE 0745750 per 100 The no-new-revenue tax rate is.

Paying Your Property Taxes. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as. The tax year is July 1st through June 30th.

The residential tax bill is divided as follows. Depending on your vehicles value you may save up to 150 more because the city is freezing the rate. Taxes are payable on November 10th 1st half and May 10th 2nd half.

What is the due date of real estate taxes in the City of Richmond. Property tax payments may be paid by cheque bank draft debit. Real property consists of land buildings.

The City of Richmond is not accepting property tax payments in cash until March 31 2021 due to pandemic safety measures. Province of BCs Tax Deferment. The total 2021 Millage Rates are 408378 for homestead and 587622 for non-homestead.

Richmond Hill - 27 per cent of. Richmond Taxes City of. If you do not pay your property taxes on time in full you will be charged a penalty of 5 on your outstanding balance.

The real estate tax rate is 120 per 100 of the properties. These agencies provide their required tax rates and the City collects the taxes on their behalf. Home Services About Richmond.

Real estate taxes are due on January 14th and June 14th each year. Understanding Your Tax Bill. The city of richmond is not.

Richmond Hill accounts for only about a quarter of your tax bill. It is estimated that by freezing the rate the city will provide Richmonders more than 8. Tax bills are mailed out on July 1st and December 1st and are due on September.

Property Taxes AND Flat Rate Annual Utilities. View Historic Tax Rates. The fiscal year 2021 tax rates are.

The rates will be adjusted for 163 cents on each 100 of personal property and 134 cents on. RICHMOND CITY OF TAX. Any remaining outstanding balance after the September 2 2022 due date.

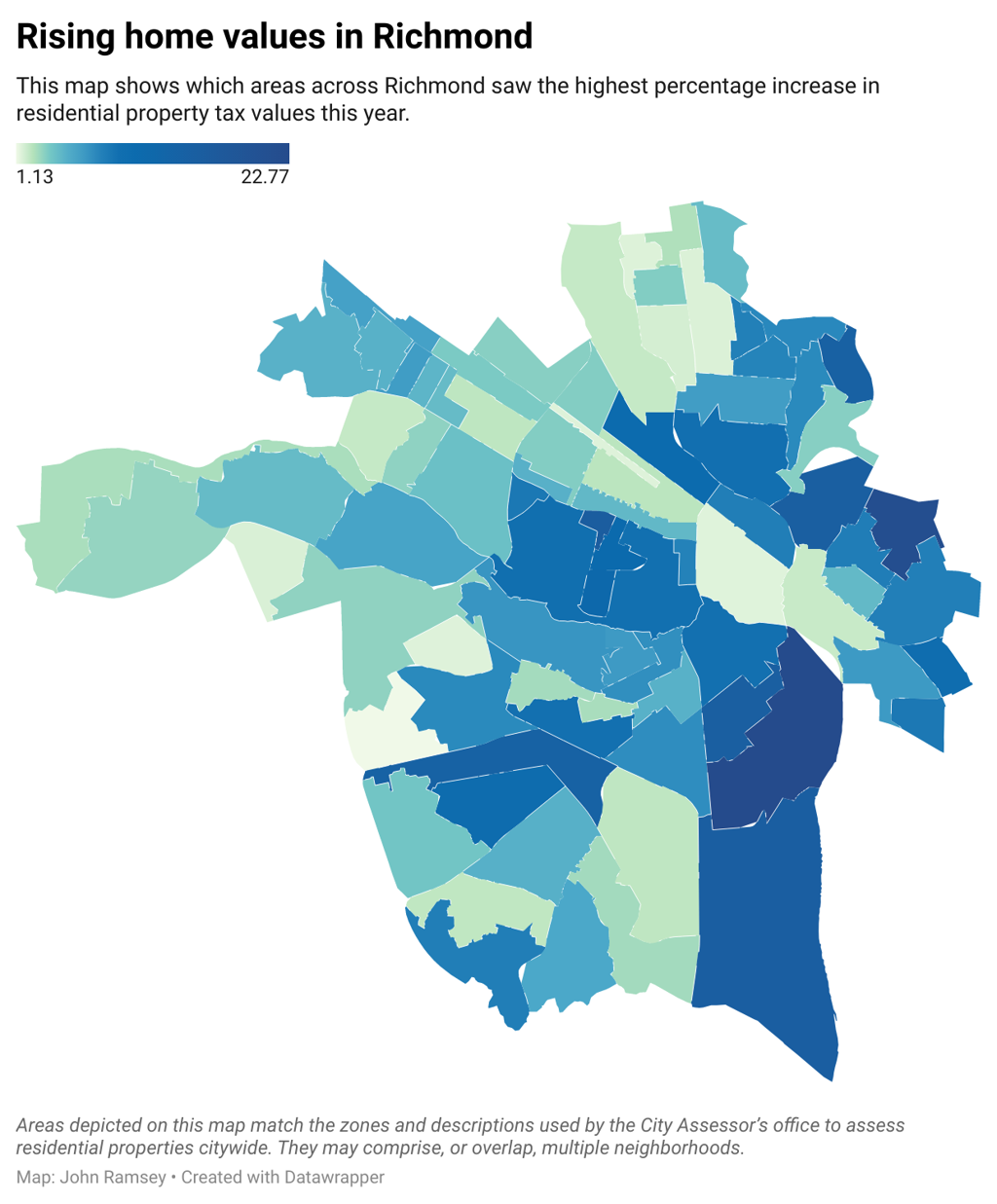

Property taxes are due once a year in richmond on the first business day of july. The new assessments will be used to calculate tax bills mailed to city property owners next year. For information and inquiries regarding amounts levied by other taxing authorities.

The November payment is for July 1st through December 31st and the. This year the city chose to select the compensating rate for the 2021 rates.

Property Taxes By State 2016 Eye On Housing

Real Estate Tax Chart Rates For Metro Richmond Ann Vandersyde Virginia Properties Long Foster Real Estate

2021 2022 Lease Enforcement Fact Sheet Richmond Redevelopment Housing Authority

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

With A Steep Property Tax Hike Looming Richmond Officials Weigh Shifting Some Of The Burden To Second Home Owners Central Berkshires Berkshireeagle Com

Buckhead Property Taxes 2021 Edition What You Need To Know Buckhead

Virginia Property Taxes By County 2022

New York City Property Tax Rate Is It Worth Selling

About Your Tax Bill City Of Richmond Hill

2022 Property Taxes By State Report Propertyshark

Richmond To Maintain Real Estate Tax Rate After Considering 6 5 Cent Rollback To Offset Rising Property Values Richmond Latest News Richmond Com

Indiana Sales Tax Rate Rates Calculator Avalara

Formerly Redlined Areas Of Richmond Are Going Green Chesapeake Bay Foundation

Gta Cities With The Highest And Lowest Property Taxes Storeys

Ontario Property Tax Rates Lowest And Highest Cities

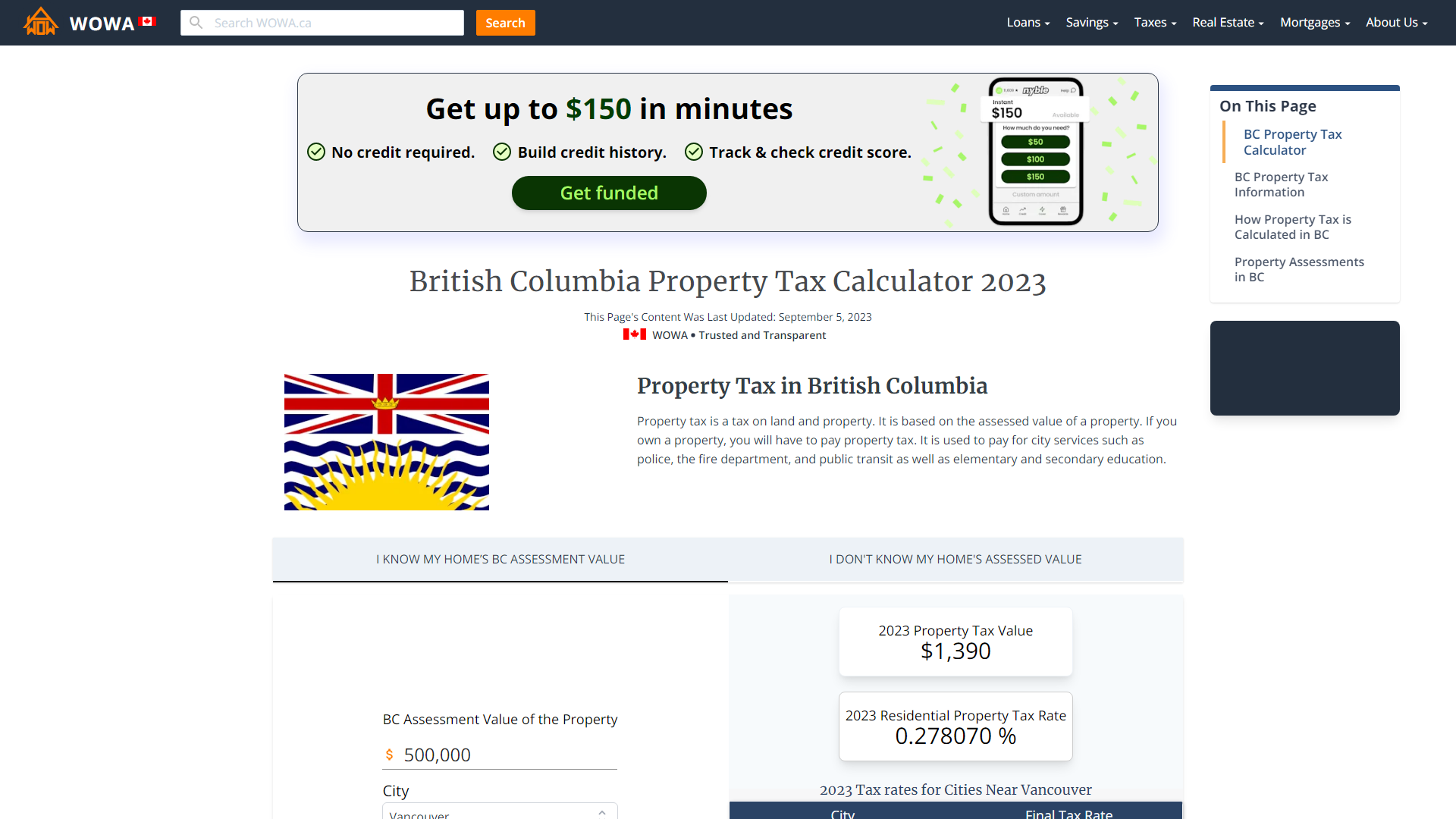

British Columbia Property Tax Rates Calculator Wowa Ca

Ontario Cities With The Highest And Lowest Property Tax Rates Canada Info

Bay Area Cities Where Homeowners Saved Up To 30k On Property Taxes In Real Estate Boom